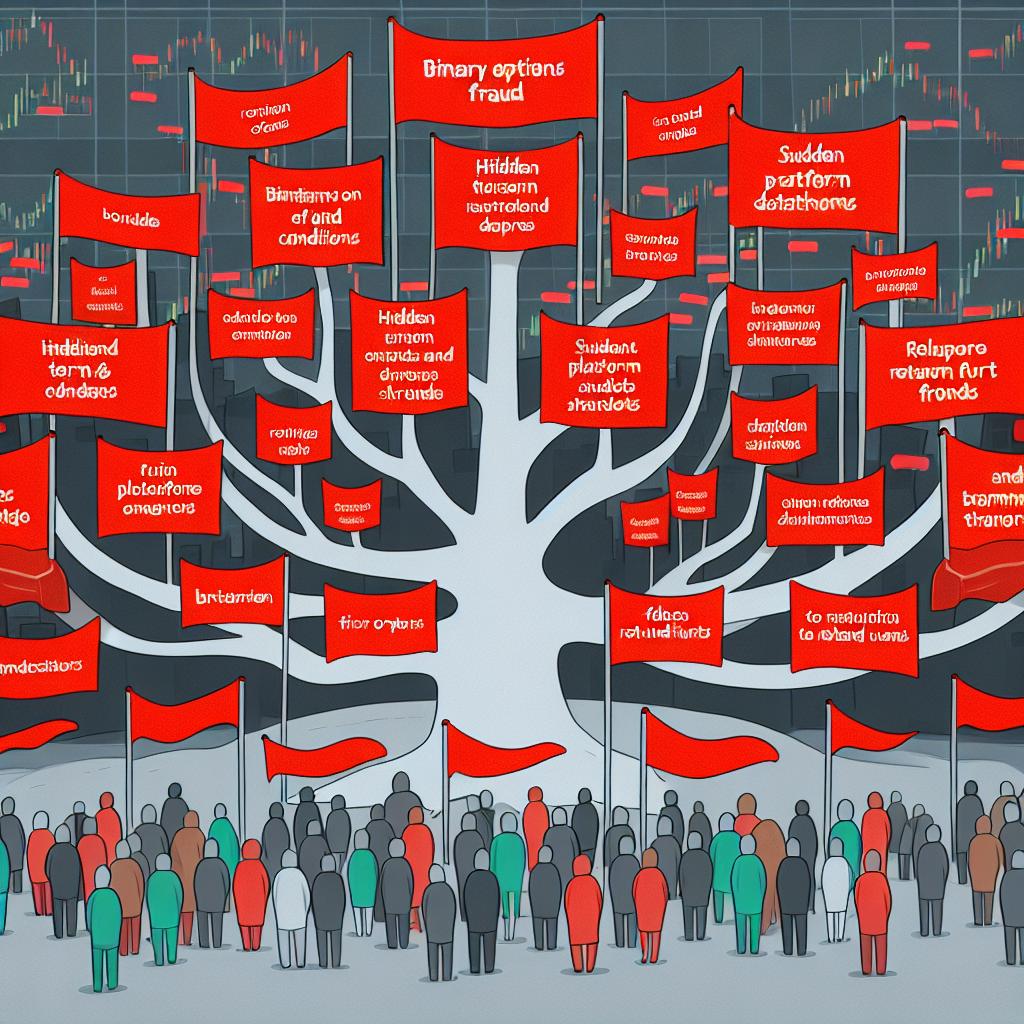

Common Red Flags of Fraudulent Binary Options Brokers

Understanding Binary Options

Binary options are a popular yet controversial type of financial instrument in the world of online trading. Defined by their all-or-nothing payoff structure, they enable investors to take advantage of the price movements of various assets, such as commodities, stocks, or currencies, without ownership. The underlying premise is straightforward: you decide if an asset’s price will increase (a “call” option) or decrease (a “put” option) by a predetermined expiration date. Despite their simplicity and potential for quick returns, binary options trading also comes with significant risks, with fraudulent activities being a persistent problem within the industry.

Recognizing Fraudulent Brokers

One of the greatest challenges in binary options trading is the prevalence of fraudulent brokers. These unscrupulous entities often exploit inexperienced traders, leading to financial losses. Identifying these brokers involves recognizing several red flags indicative of fraudulent behavior. Here are some crucial considerations when evaluating a broker’s legitimacy.

Lack of Regulation

A common feature of fraudulent brokers is the absence of proper regulatory oversight. Legitimate brokers usually operate under the watchful eye of recognized financial regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the United States. These organizations ensure that brokers adhere to established legal and ethical standards. Always verify whether a broker is licensed by a reputable regulatory agency. You can typically find this information on the regulator’s website or the broker’s official site, where they should display their licensing details prominently.

Unrealistic Returns

One of the most alluring aspects of binary options is the potential for high returns. However, offers of guaranteed profits or extremely high returns with little to no risk are suspicious and often indicative of fraudulent activity. Legitimate brokers present a balanced view of both the potential gains and the inherent risks involved. They do not promise returns that sound too good to be true. Exercising skepticism in the face of such claims is crucial for avoiding scams.

Lack of Transparency

Transparency is a cornerstone of a trustworthy broker-investor relationship. Legitimate brokers will provide comprehensive information about their services, including trading terms and conditions, fee structures, and contact information. If a broker’s operations are shrouded in secrecy or if they are reluctant to disclose critical aspects of their service, this is a substantial warning sign. Transparency extends to understanding how the platform executes trades and handles customer data. Any ambiguity in these areas should prompt caution.

Difficulty Withdrawing Funds

The ability to withdraw your funds efficiently is a fundamental aspect of a legitimate broker service. A common tactic among fraudulent brokers is to create barriers when clients attempt to withdraw their funds. These hurdles might come in the form of hidden fees, unexpected delays, or complex requirements. Legitimate brokers will honor withdrawal requests promptly and will clearly outline any applicable conditions or fees in advance. If a broker imposes unreasonable challenges during withdrawal attempts, it raises a significant red flag.

Poor Customer Support

Effective customer support is essential for facilitating successful trading experiences. Legitimate brokers invest in responsive and knowledgeable customer service teams to address traders’ concerns promptly. If a broker’s support is unresponsive, evasive, or unhelpful, this may indicate potential underlying issues. Reliable customer support is particularly important for new traders who may require guidance or assistance in navigating trading platforms or resolving issues.

Safeguarding Your Investments

Ensuring the security of your investments in binary options trading involves thorough research and caution. Here are some practical steps to help safeguard against fraudulent brokers:

Conduct Comprehensive Research: Utilize online forums, reviews, and trusted financial websites to gather information about a broker’s track record and reputation. Engaging with other traders’ experiences can offer valuable insights into which brokers are reputable.

Start Small: Before committing substantial funds, consider starting with a small investment to test the broker’s functionality and policies. This approach minimizes risk while allowing you to assess the broker’s reliability.

Leverage Expert Resources: Access expert resources and guides available online to educate yourself about binary options trading. This can enhance your understanding of market dynamics and offer strategies to manage risks effectively.

Conclusion

Binary options trading offers opportunities for profit, but it comes with its own set of risks, particularly from fraudulent brokers seeking to deceive unsuspecting investors. Understanding and recognizing the common red flags associated with illicit operations are critical in safeguarding your investments. When selecting a broker, prioritize transparency, positive reviews from other traders, and proper regulation. To further enhance your trading experience, seek out comprehensive educational materials and reliable sources of information about safe trading practices.

For additional guidance on sound investment practices and broker verification, you can visit Investor.gov. This platform offers a wealth of resources designed to assist individuals in navigating the complexities of the financial markets, ensuring they can make informed and secure investment decisions.

This article was last updated on: March 10, 2025